Over half a million Australian homes are at high risk of becoming uninsurable for flood damage by 2030, according to a new report by Climate Valuation, specialists in physical climate risk analysis for individual property owners.

Climate Valuation’s new report, ‘Going Under: The Imperative to act in Australia’s flood risk suburbs’, also identifies the suburbs where property buy-back and community relocation may have to be considered, and where urgent investment in adaptation is essential for the suburb to remain viable.

The report is being released so that homeowners are no longer kept in the dark about their risk and to call for collaboration between government, business and homeowners to move communities from risk to resilience in the face of increasing climate-exacerbated extreme weather.

“People living in homes at high risk of riverine flooding are there through no fault of their own. Yet they are being left in an untenable position, with few if any options…The challenge therefore is not to find fault, but to find solutions…Residents, banks, insurers and governments are all likely to lose out if these risks go on unchecked,” said Climate Valuation CEO Dr Karl Mallon.

This Going Under: The Imperative to act in Australia’s flood risk suburbs report looks at the risk of damage from riverine flooding to residential homes across Australia by 2030. It analyses 14,739,901 individual addresses, and 14,995 suburbs under an RCP 8.5 scenario.

Key findings:

- By 2030, over 3 million Australian homes (21%) have exposure to some level of riverine flooding.

- By 2030, 588,857 Australian homes are considered High Risk Properties and carry a high risk of becoming uninsurable for flood cover because it is either prohibitively expensive or withdrawn.

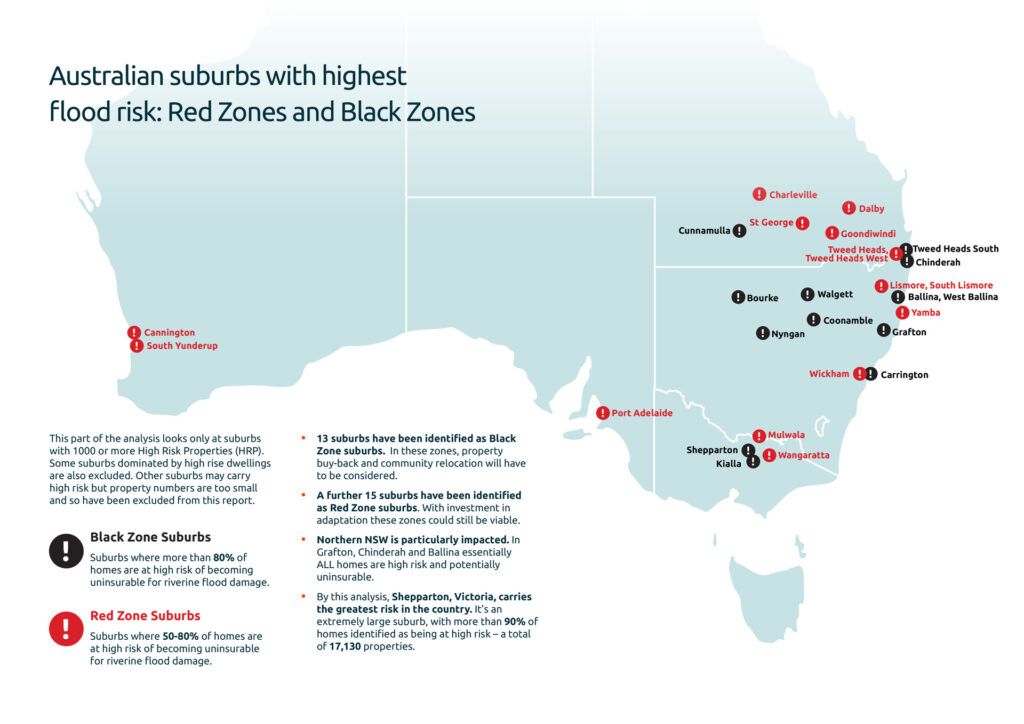

- 13 suburbs are identified as Black Zone suburbs: In these areas, (defined as suburbs where over 80% of homes risk becoming uninsurable by 2030) property buy-back and community relocation will have to be considered.

- A further 15 suburbs are identified as Red Zone suburbs: These areas,(defined as suburbs where 50-80% of homes risk becoming uninsurable by 2030) require urgent investment in adaptation to remain viable.

- Northern NSW is particularly impacted. In Grafton, Chinderah and Ballina essentially ALL homes are high risk and potentially uninsurable.

The report lays out a series of recommendations for insurers, banks and government, including freely available, national flood risk mapping for Australia, buy-back schemes, adaptation grants and regulation relating to building in flood zones.

“It is not too late if we act now. Solutions are available to ensure homeowners are removed from physical and financial harm. We hope that the stark and very specific findings in this report will provoke the kind of national policy response and co-operation required,” said Dr Mallon.

About Climate Valuation

Climate Valuation is the first, and only, company to provide professional, investment-grade physical climate risk analysis to individual property owners on a global scale. Its mission is to empower individuals with the information to understand the costs of climate change to residential property, leading to greater transparency, better decision making and improved community resilience.

Climate Valuation is part of The Climate Risk Group, a group of companies committed to quantifying and communicating the costs of climate change. Climate Valuation’s partner company, XDI (Cross Dependency Initiative) provides analysis to key decision makers including government, investors, corporates and financial institutions.