Find out the current and future climate impacts to an individual property.

Through the use of sophisticated climate modelling, Climate Valuation’s National Climate Insights Study has identified a number of key issues affecting Australian homebuyers and homeowners.

Click on each of the key takeouts to jump down the page and read more.

Through the use of sophisticated climate modelling, Climate Valuation’s National Climate Insights Study has identified a number of key issues affecting American homebuyers and homeowners.

Click on each of the key takeouts to jump down the page and read more.

Through the use of sophisticated climate modelling, Climate Valuation’s National Climate Insights Study has identified a number of key issues affecting Canadian homebuyers and homeowners.

Click on each of the key takeouts to jump down the page and read more.

As a result of just 1.1 degree of global warming to date, 3.4% or nearly half a million properties in Australia are already considered high risk of damage from climate change and extreme weather.

This number rises to nearly 650,000 properties by 2050 and 1.13 million properties by the end of the century, not accounting for future development or growth in housing stock.

This figure represents the number of existing properties that are most likely to face unaffordable or unavailable insurance due to the increasing frequency and severity of extreme weather events.

This has the potential to trigger broader financial impacts as homeowners in higher risk areas begin to struggle with mortgage serviceability and declining property values, amid wider ongoing climate change impacts to the economy.

Learn more

| Year | # of low risk properties | # of moderate risk properties | # of high risk properties |

|---|---|---|---|

| 1990 | 12,937,193 | 967,584 | 410,586 |

| 2022 | 12,615,522 | 1,207,896 | 491,945 |

| 2030 | 12,502,550 | 1,291,593 | 521,220 |

| 2050 | 11,688,778 | 1,979,181 | 647,404 |

| 2080 | 11,269,231 | 2,151,165 | 894,967 |

| 2100 | 10,061,074 | 3,120,189 | 1,134,100 |

It is estimated that the annualised costs of damage from extreme weather events has increased by 25% since 1990 due to climate change. The current estimate of the impact of extreme weather risk on the average Australian’s home insurance is $593 per household (referred to as Technical Insurance Premium). Extrapolated Australia-wide, this equates to almost $8.5 billion worth of damage to property in the current year. Insurance premiums have likely not kept up with this underlying risk and a price correction is expected for many at-risk regions.

Looking forward, insurance costs for extreme weather may increase a further 70% by 2050 and 360% by the end of the century. In some high risk locations, insurance may become unaffordable or be withdrawn all together. The availability of affordable insurance is key to the safety and well-being of communities, as well as the broader economic resilience of Australia.

Read more

As residential property buyers start to consider climate change and insurance costs in their purchasing decisions, it is anticipated that properties highly exposed to extreme weather and climate change impacts will decrease in value relative to the rest of the market.

The total value of this correction is likely to exceed $700bn by 2100 (based on today’s housing stock). In percentage terms a property at high risk from climate change and extreme weather is likely to decline in value by over 4% by 2050 and over 9% by 2100 relative to an equivalent low-risk property.

This may leave some homeowners with mortgages that exceed the sale value of their property (negative equity).

Read more

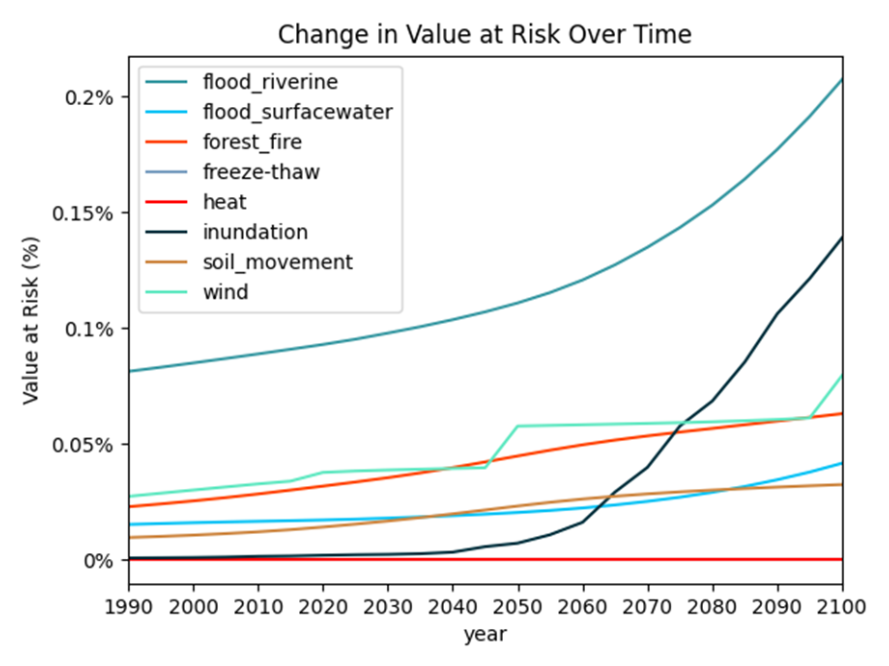

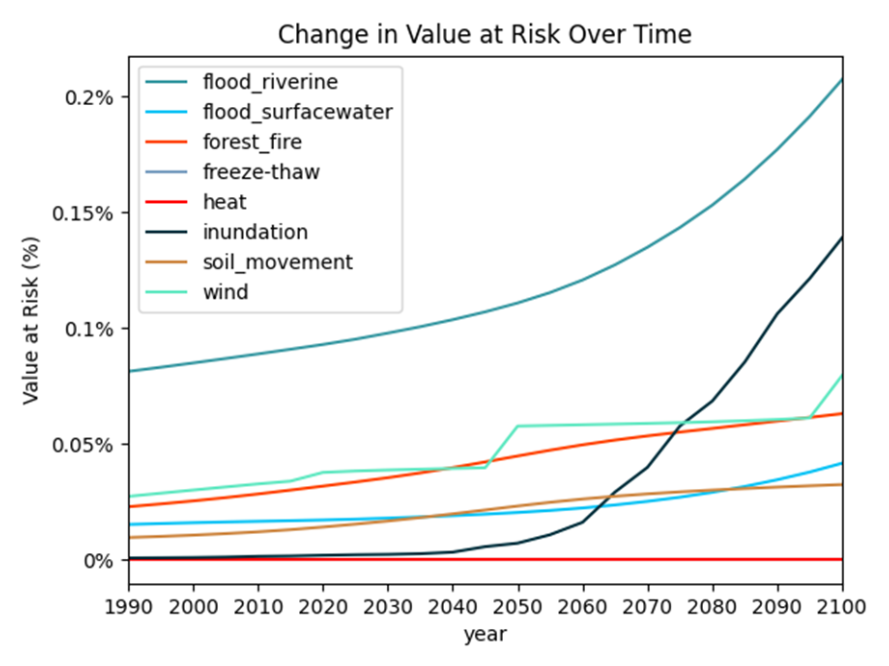

Riverine flooding is estimated to drive the most property damage in the first half of the century, contributing nearly half of all extreme weather related risk in 2022.

After 2050, damage from coastal inundation risk rises dramatically, from just 1% of total maximum value-at-risk today, to nearly a quarter of the total value-at-risk at the end of the century. While damage may not actualise for many properties until 2070, the market revaluation of at-risk coastal properties is expected to occur earlier.

Extreme wind & cyclone risk increases into the later half of the century as cyclonic wind conditions migrate south towards highly populated areas with lower building design standards. Bushfire risk also increases into the century as extreme heat days increase

Read more

It is estimated that the annualised costs of damage from extreme weather events has increased by 25% since 1990 due to climate change.

The current estimate of the impact of extreme weather risk on the average Australian’s home insurance is $593 per household (referred to as Technical Insurance Premium). Extrapolated Australia-wide, this equates to almost $8.5 billion worth of damage to property in the current year. Insurance premiums have likely not kept up with this underlying risk and a price correction is expected for many at-risk regions.

Looking forward, insurance costs for extreme weather may increase a further 70% by 2050 and 360% by the end of the century. In some high risk locations, insurance may become unaffordable or be withdrawn all together. The availability of affordable insurance is key to the safety and well-being of communities, as well as the broader economic resilience of Australia.

As residential property buyers start to consider climate change and insurance costs in their purchasing decisions, it is anticipated that properties highly exposed to extreme weather and climate change impacts will decrease in value relative to the rest of the market.

The total value of this correction is likely to exceed $700bn by 2100 (based on today’s housing stock). In percentage terms a property at high risk from climate change and extreme weather is likely to decline in value by over 4% by 2050 and over 9% by 2100 relative to an equivalent low-risk property.

This may leave some homeowners with mortgages that exceed the sale value of their property (negative equity).

Riverine flooding is estimated to drive the most property damage in the first half of the century, contributing nearly half of all extreme weather related risk in 2022.

After 2050, damage from coastal inundation risk rises dramatically, from just 1% of total maximum value-at-risk today, to nearly a quarter of the total value-at-risk at the end of the century. While damage may not actualise for many properties until 2070, the market revaluation of at-risk coastal properties is expected to occur earlier.

Extreme wind & cyclone risk increases into the later half of the century as cyclonic wind conditions migrate south towards highly populated areas with lower building design standards. Bushfire risk also increases into the century as extreme heat days increase.

Although all Australians are affected by climate change, certain areas face greater risk. The worst impacts of climate change on property are felt in relatively localised areas of the country. These ‘red zones’ are where insurance may become unaffordable or unavailable and pinpoint areas where adaptation efforts should be prioritised. Relocation of homes and communities may become an increasing reality for some of the most impacted areas of the country, particularly if action to reduce carbon emissions is further delayed.

*based on number of high-risk properties

| Queensland | New South Wales | Victoria | Western Australia | South Australia | Tasmania | ACT | Northern Territory | |

|---|---|---|---|---|---|---|---|---|

| 1 | Surfers Paradise | Ballina | Shepparton | South Perth | West Lakes | Invermay (Tas.) | O’Connor (ACT) | Larrakeyah |

| 2 | Brisbane City | Tweed Heads South | Wangaratta (Vic.) | Cannington | Belair | Launceston | Phillip | East Side |

| 3 | Newstead (Qld) | Tweed Heads West | Port Melbourne | East Perth | Grange (SA) | Longford (Tas.) | Kingston (ACT) | The Gap (NT) |

| 4 | West End (Brisbane) | Mulwala | Kialla | Baldivis | Semaphore Park | Hobart | Lyneham | Sadadeen |

| 5 | South Brisbane | Chinderah | Horsham | Northam | Hawthorndene | Queenstown (Tas.) | City | Darwin City |

| 6 | Dalby | West Ballina | Mildura | Perth (WA) | West Lakes Shore | Hadspen | Harrison | Stuart Park |

| 7 | Hamilton (Qld) | Coonamble | South Yarra | Shelley (WA) | Mawson Lakes | New Norfolk | Braitling | |

| 8 | Yarrabilba | Bourke | South Melbourne | Ascot (WA) | Port Adelaide | Latrobe | Katherine East | |

| 9 | New Farm | Nyngan | Kensington (Vic.) | Wilson | Goolwa | Huonville | Howard Springs | |

| 10 | Pimpama | Parramatta | Echuca | Ferndale (WA) | Renmark | Deloraine | Berrimah |

Although all Australians are affected by climate change, certain areas face greater risk. The worst impacts of climate change on property are felt in relatively localised areas of the country. These ‘red zones’ are where insurance may become unaffordable or unavailable and pinpoint areas where adaptation efforts should be prioritised. Relocation of homes and communities may become an increasing reality for some of the most impacted areas of the country, particularly if action to reduce carbon emissions is further delayed.

*based on number of high-risk properties

| Queensland | New South Wales | Victoria | Western Australia | South Australia | Tasmania | ACT | Northern Territory | |

|---|---|---|---|---|---|---|---|---|

| 1 | Surfers Paradise | Ballina | Shepparton | South Perth | West Lakes | Invermay (Tas.) | O’Connor (ACT) | Larrakeyah |

| 2 | Brisbane City | Tweed Heads South | Wangaratta (Vic.) | Cannington | Belair | Launceston | Phillip | East Side |

| 3 | Newstead (Qld) | Tweed Heads West | Port Melbourne | East Perth | Grange (SA) | Longford (Tas.) | Kingston (ACT) | The Gap (NT) |

| 4 | West End (Brisbane) | Mulwala | Kialla | Baldivis | Semaphore Park | Hobart | Lyneham | Sadadeen |

| 5 | South Brisbane | Chinderah | Horsham | Northam | Hawthorndene | Queenstown (Tas.) | City | Darwin City |

| 6 | Dalby | West Ballina | Mildura | Perth (WA) | West Lakes Shore | Hadspen | Harrison | Stuart Park |

| 7 | Hamilton (Qld) | Coonamble | South Yarra | Shelley (WA) | Mawson Lakes | New Norfolk | Braitling | |

| 8 | Yarrabilba | Bourke | South Melbourne | Ascot (WA) | Port Adelaide | Latrobe | Katherine East | |

| 9 | New Farm | Nyngan | Kensington (Vic.) | Wilson | Goolwa | Huonville | Howard Springs | |

| 10 | Pimpama | Parramatta | Echuca | Ferndale (WA) | Renmark | Deloraine | Berrimah |

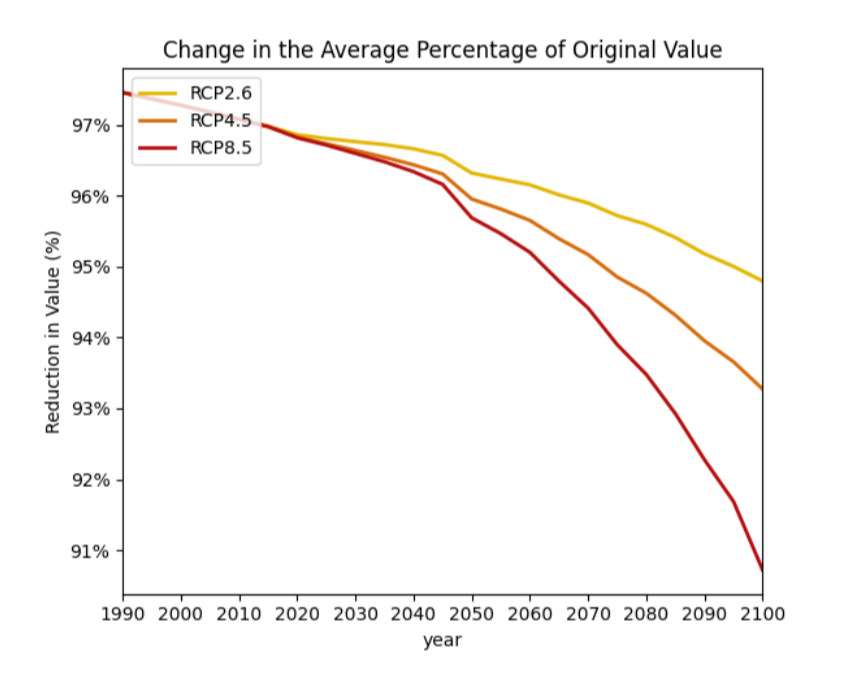

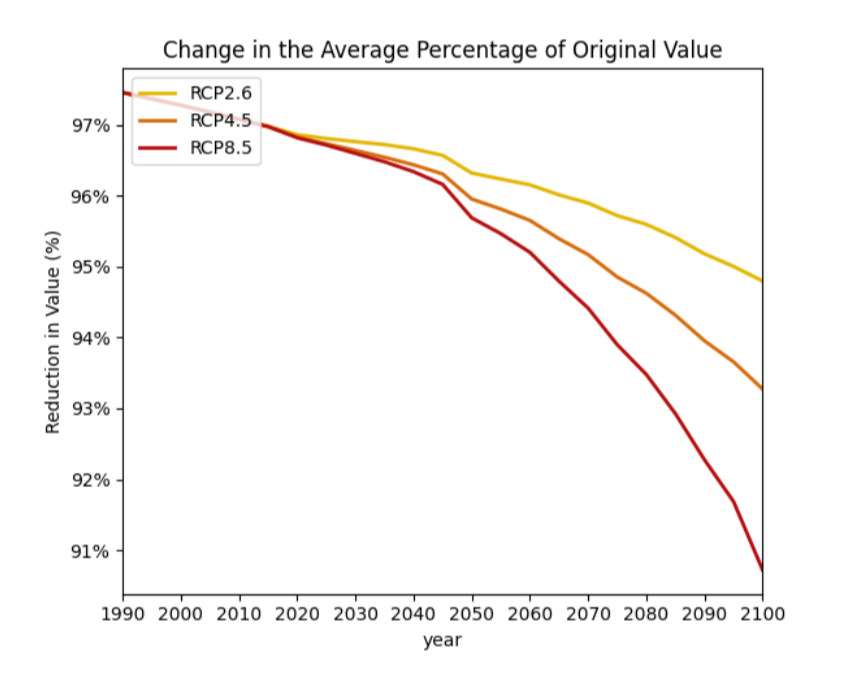

The costs of climate change impacts on Australian homeowners varies dramatically depending on the success or otherwise of efforts to reduce carbon emissions across the economy.

Under the current scenario where emissions continue to rise and mean surface temperatures rise by around 3-4 degrees celsius by 2100, up to 30% of Australian households may be moderately or severely impacted by climate change.

Put another way, the cost to households caused by climate change can be reduced by almost half if global carbon emissions are reduced in line with the Paris Agreement and reach net zero by 2050.

Risks from climate change to someone’s house are highly specific, varying according to the siting of the property, its location, build materials and design, among other things. Climate Valuation’s Comprehensive Climate Impact Report provides users with detailed information on climate risks to individual properties to help with the process of buying, selling or upgrading a home. If your current property or next home is in a higher risk zone, run a comprehensive climate impact report to learn more about its individual risk.

Risks from climate change to someone’s house are highly specific, varying according to the siting of the property, its location, build materials and design, among other things. Climate Valuation’s Comprehensive Climate Impact Report provides users with detailed information on climate risks to individual properties to help with the process of buying, selling or upgrading a home. If your current property or next home is in a higher risk zone, run a comprehensive climate impact report to learn more about its individual risk.

This tool covers risks from riverine flooding, surface water flooding, coastal inundation, bushfires, extreme wind, cyclone and movement of clay soils due to drought. It does not include landslip, grass fires, hail, coastal erosion, lightening or any other hazards apart from those specifically identified.

| Coastal Inundation | Sea water flooding due to high tides, wind, low air pressure and waves. |

| Extreme Wind & cyclone | Changes in wind regimes, sea surface temperature and wind speeds. |

| Bushfire | Increased incidence of fire weather due to confluence of days with higher temperatures, high wind speeds and drier conditions. |

| Riverine Flooding | Changes in precipitation in a catchment that causes a river to exceed its capacity, inundating nearby areas. |

| Drought & Soil Movement | Soil contraction due to reduced rainfall which can cause subsidence damage to structures. |

| Surface Water Flooding | Increased frequency of extreme rainfall leading to overland flooding. |

High, Moderate and Low risk thresholds are based on the USA Federal Emergency Management Agency (FEMA) thresholds for government insurance schemes, which highlight properties in an (historic) 1-in-100 flood zone, also known as “Rating A Zones”. These thresholds have been adjusted to accommodate for other hazards and property resilience.

High risk homes have annual damage costs from climate change and extreme weather equivalent to 1% or more of the property’s replacement cost. These properties are effectively uninsurable, as – whilst policies might still be offered by some insurance companies – insurance premiums are expected to become too expensive for people to afford, making insurance inaccessible.

Medium risk properties have annual damage costs equivalent to 0.2-1.0% of the property replacement cost. These properties are at risk of being underinsured.

| High Risk | MVAR% > 1.0% | Insurance may be high cost or unavailable unless adaptation actions are undertaken |

| Moderate Risk | 0.2% < MVAR% < 1.0% | Risk may lead to higher insurance costs |

| Low Risk | MVAR% < 0.2% | Risk may be insurable at reasonable cost |

The Technical Insurance Premium (TIP) is defined here as the Annual Average Loss (AAL) modelled for all climate change & extreme weather hazards combined. The TIP is based on the cost of damage to a property, expressed in current day currency with no discounting or adjustments for other transaction costs.

The Total TIP (TTIP) is the sum of all TIPs for all properties in a given area, for example all addresses in a suburb. As such, the TTIP is useful in drawing attention to the clustered financial risks associated with climate change hazards.

The Maximum Percentage of Value at Risk (MVAR%) is the Annual Average Loss (AAL) modelled for all climate change & extreme weather expressed as a percentage of a single property’s replacement cost, specified for a one year period with no discounting.

MVAR% = AAL / asset replacement cost

The MVAR% can also be applied to a group of properties, in which case Average MVAR% is the Total Annual Average Loss (AAL) divided by the total replacement value of all properties.

The MVAR% is an excellent way of overcoming the bias toward larger properties and / or areas with higher concentrations of value.

The percentage of High Risk Properties (%HRP) is the sum of all properties for which the MVAR% is above 1.0% of the replacement cost of the property in a given year divided by the total number of properties in the area. The higher the HRP%, the greater the concentration of ‘high risk’ properties in the area.

Climate Adjusted Value (CAV) assumes that borrowed funds are finite and that money spent on insurance or self-insurance against extreme weather and climate related hazards must redirect financial resources away from servicing a mortgage or loan on that asset. Using a default interest rate, this diversion of funds is calculated as an equivalent reduction in the principal value of the loan that may be borrowed.

As the value of a property may fluctuate with the market, the reduction in the lending capacity is expressed as a percentage reduction in equivalent value. The Climate Adjusted Value is therefore the percentage reduction in value for the Representative Property, relative an equivalent property unaffected by extreme weather & climate change.

Not to be taken as forecasts or predictions

Climate Valuation does not purport to generate statements of fact, forecasts or predictions, nor imply any representation regarding the likelihood, risk, probability, possibility or expectation of any future matter. To the extent that any statements made or information contained or generated might be considered forward-looking in nature, they are subject to physical, political, regulatory, technological and stakeholder-related variables and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on any such forward-looking statements, which reflect assumptions and information available only as of the date of modelling. No explicit or implicit assumption is made in relation to the current or future alignment of any climate change-related scenarios with climate- related policies of any government at international, national or sub-national level. The impacts of climate change analysed are only for one potential greenhouse gas emission and global warming scenario presented in the Intergovernmental Panel on Climate Change Assessment Report (IPCC 2014, IPCC 2007).

Not to be taken as financial advice

The information presented does not comprise, constitute or provide, nor should it be relied upon as, investment or financial advice, credit ratings, an advertisement, an invitation, a confirmation, an offer or a solicitation, or recommendation, to buy or sell any security or other financial, insurance, credit or lending product or to engage in any investment activity, or an offer of any financial service. As this analysis is based on a ‘representative property’, the information in this report does not purport to quantify risk to the actual subject land, infrastructure, buildings or other physical assets or any part thereof, nor make any representation in regards to the saleability, mortgage ability, insurability, or defects, of any real subject property, nor its suitability for purchase, holding or sale. No representation is made in relation to the availability or coverage of insurance to an actual or planned property. The Modelling Outputs presented are provided with the understanding and expectation that each user will, with due care, conduct their own investigation and evaluation of any real or planned asset at a specific location.

Exclusion of liability

To the extent permitted by law Climate Valuation, Climate Risk p/l and analytic suppliers will not be liable for any loss or damage, whether in contract, tort (including negligence), breach of statutory duty or otherwise, even if foreseeable, arising under or in connection with use of or reliance on any information, data or content obtained via our services, including (without limitation) the modelling outputs presented.

Disclaimer

While every effort has been made to ensure that this tool and the sources of information used herein are free of error, the authors: Are not liable for the accuracy, currency and reliability of any information provided; Make no express or implied representation of warranty that any estimate of forecast will be achieved or that any statement as to the future matters contained in this tool will prove correct; Expressly disclaim any and all liability arising from the information contained in this tool including, without, errors in, or omissions contained in the information; Except so far as liability under any statute cannot be excluded; Accept no responsibility arising in any way from errors in, or omissions contained in the information; Do not represent that they apply any expertise on behalf of the reader or any other interested party; Accept no liability for any loss or damage suffered by any person as a result of that person, of any other person, placing any reliance on the contents of this publication; Assume no duty of disclosure or fiduciary duty to any interested party.

The Climate Risk Engines are purpose built to compute hypothetical future risks to a modeled asset (synthesized with engineering data) that is designed to represent property and other infrastructure. The system enables each such asset to be stress-tested against a wide range of extreme weather and extreme sea events typical of its location.

A range of future-looking scenarios can be applied that are consistent with different greenhouse gas emission scenarios, atmospheric sensitivity and response, adaptation pathways, building standards and planning regimes. The Climate Risk Engines combine engineering analysis with statistical analysis of historical weather and climate projections, and probabilistic methods for financial analysis of risk and value.

It’s important to note that these results apply to a synthetic ‘Representative Property’ under a range of future scenarios. The results cannot therefore be taken as representations of the actual future risks to, or value of, a real or planned property or infrastructure asset.

In order to assess climate change and extreme weather risk to residential property across Australia, the system creates ‘Representative Properties’ which are synthetic representations of hypothetical property and places them at each known address in the country. Information about each Representative Property is then processed together with other relevant information such as its location, topography, soil composition and local weather patterns.

The system stress tests each component element of each ‘Representative Property’ against the extreme weather conditions to which it will likely be exposed, to determine the probability of failure or damage in each given year. Finally, risk and damage projections are adjusted to account for the modelled changes in frequency and intensity of each climate change related event (flooding, fire, drought), based on interpretations of global and regional climate models.

Future probabilities of damage are calculated by extracting changes in statistical distribution of key parameters such as heat, wind, humidity and precipitation to show the changing vulnerability of a property under a range of possible future emission scenarios and warming outcomes

The Climate Risk Engines integrate the information sent to it with information from a large number of national and international datasets from government institutions, universities and private companies to provide a generalised model of how climate change may affect a number of physical risks to the Representative Property, all else being equal.

A “Representative Property”, with corresponding design and construction settings indicative of a ‘moderately resilient’ free standing house has been used as a stand-in for actual properties to enable en-mass analysis of climate risk across all Australian properties. Some characteristics of this ‘Representative Property’ are outlined below.

The design and construction settings used materially impact the vulnerability of the property to the hazards to which it is likely to be exposed and cannot be taken as confirmation of the actual future risks to, or value of, an actual or planned property or infrastructure asset. The analysis also does not necessarily take into account the impact of any built infrastructure, modifications, adaptations or resilience building measures (public or private) that have been, or may be, applied that reduce (or exacerbate) the relevant risks. It is recommended that individual property owners verify the climate risk profile of their own property, using real design and construction attributes.

| PROPERTY CHARACTERISTIC: | SETTINGS USED: |

| Property Archetype used: | A moderately Resilient Free Standing House |

| Number of properties analysed: | 14,313,587 |

| Assumed Market Value: | $533,800 |

| Assumed Replacement Value of Building: | $313,800 |

| Assumed Build Year: | Year 2000 |

| Assumed Floor Height Above Ground: | 0.1m |

| Assumed Ignition Probability: | Average Protection |

| Assumed Foundation Design: | Non-Rigid Reinforced Concrete |

| Assumed Wind Speed Threshold (WST): | 1 in 500 years |

| Assumed Temperature Exposure: | 42 degrees |

This tool examines the modelled impacts of climate change and extreme weather on Australia’s residential property under a ‘business as usual’ greenhouse gas emission and global warming scenario presented in the Intergovernmental Panel on Climate Change Assessment Reports (IPCC 2007; 2014) which models global warming temperature increase of between 3.2°C to 5.4°C by the end of 2100.

Science is not able to definitively predict the exact range or rate of future global warming; or the scale and rate of change of atmospheric and oceanic processes that may be hazardous, including temperatures, precipitation, wind and the rise in sea levels that result from this warming. Many variables will determine society’s continuing rate of emission of ‘greenhouse gases’ (including political, regulatory, technological and behavioural factors), and how the Earth’s natural systems respond. However, we can estimate a range of potential impacts across what mainstream science considers to be a plausible

set of scenarios for future ocean and atmospheric behaviour.

The results shown in this insights tool are only one possible view of the future and representation of climate change. No explicit or implicit assumption is made in relation to the current or future alignment of any climate change-related scenarios with climate related policies of any government at international, national or subnational level.

Lower emission pathways RCP4.5 and RCP2.6 are computed, but not the focus of the results within this tool.

The information presented in this insights tool has been generated using an expert selection of the scientific methods and computational modelling techniques available at the time of creation. However, at any time, these calculations are subject to physical, political, regulatory, technological, stakeholder related variables and uncertainties that could cause results to differ materially.

There are a number of limitations effecting this analysis of which users should make themselves aware. These are constantly refined and updated and more information on such variables is available on the Climate Valuation methodology page.

The analysis does not purport to ‘cover the field’ of all potential risks associated with climate change nor to address coincidence or correlation between such risks. For example, extremes of precipitation and flooding may be coincident with extreme wind-storms which can damage a building making it more vulnerable to damage.

It is also important to note that the analysis is conducted on a “Representative Property”. The Climate Risk Engines do not necessarily take into account the impact of any actual built infrastructure, modifications, adaptations or resilience-building measures (public or private) that have been, or may be, applied

that reduce (or exacerbate) the relevant hazard. Therefore Climate Risk Engines do not provide a forecast, prediction or projection based on any actual or planned property.

Find out the risks to your property with a FREE site check

< Insert search bar >

Website developed by The Marketing GP